long island tax grievance

- You are the authorized homeowner of. Long Island Commercial Tax Grievance.

Heller Consultants Tax Grievance Long Island Tax Grievance Youtube

I Agree to Pay Nothing Unless My Taxes Are Reduced.

. We will recommend you to all of our. Thank you Long Island Tax Grievance. You Can Receive Hundreds of Thousands In Property Tax Refunds.

The deadline is before March 1 2019 so you need to file your grievance by then or you will need to wait until March 1 2020 before you can file a grievance covering the 2021 to 2022 tax year. In exchange for property tax grievance services I the owner contract vendee or authorized agent agree to pay. Upon filing a tax grievance your property tax assessment can be lowered or remain the same but can not be increased and no one will come to your home.

Our property tax grievance consultants on Long Island will provide Pro Se assistance to our clients giving you the knowledge to get the largest reduction. As you know Suffolk homeowners pay some of the highest taxes in the nation. Taxes-Consultants Representatives Real Estate Agents.

In Commercial Tax Savings. YEARS IN BUSINESS 631 678-5675. Get listed with Long Island Exchange today by calling 631-592-4425 and speaking with our dedicated Long Island business directory editors.

There is no risk involved in filing. - You agree to pay Long Island Tax Grievance a one-time fee equal to 50 of the tax reduction amount within 30 days of notification. If your property is located in a village that assesses property you.

File the grievance form with the assessor or the board of assessment review BAR in your city or town. Our property tax grievance. What are the fees for grieving my.

Visit Website Email Business. Superior Property Tax Grievance Pro Se Consultation Service with 20 years of home valuation experience and over 10 years specializing in property tax grievances. Trusted By Over 10000 Long Island Realtors Since 2007.

TALK TO AN EXPERT. We got an accepted offerit was really because of your immediate email back re. Reduce Your Property Taxes Get in Touch.

We are a local company specializing in Suffolk County property tax grievances. Shalom Maidenbaum and his team have been successfully helping Nassau County Long Island taxpayers maintain a fair. 333 Route 25A Suite 120.

You saved us over 2100 on our annual taxes and then saved my mother-in-law over 1700 on her house. Heller Consultants Tax Grievance specializes in grieving property taxes on Long Island for both Suffolk and Nassau counties saving homeowners thousands. As a result homeowners.

Long Island Tax Grievance. Your Friendly Neighborhood Property Tax Reducer. Property Tax Solution of New York LLC is a leading real estate tax reduction company on Long Island.

Heller Consultants Tax Grievance. Rocky Point NY 11778.

Nassau County Property Tax Reduction Tax Grievance Long Island

All Information Storage Property Tax Reductions East Northport Ny

Long Island Property Tax Grievance Heller Consultants Tax Grievance

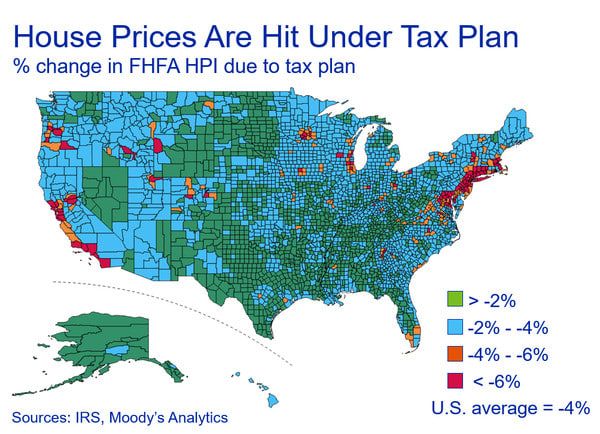

Live On Long Island 9 Things You Should Know About The New Tax Plan

Home Realty Tax Challenge Ny Commercial Property Tax Grievance Consultants

Property Tax Reduction Property Tax Grievance Services Nassau County Long Island Ny

Heller Consultants Tax Grievance 11 Reviews 333 Rt 25 A Rocky Point Ny Yelp

Long Island Tax Grievance Reduce Long Island Taxes 888 861 8883 Youtube

How The Tax Grievance Process Works In Suffolk County Ny Youtube

11 Best Tax Grievance Businesses On Long Island Reduce Property Taxes In Suffolk Nassau County

Property Tax Assessment Grievance Workshop Herald Community Newspapers Liherald Com

All Island Tax Grievance Facebook Huntington Ny

Long Island Homeowners You Still Have Time To Challenge Your County Property Tax Assessment And Reduce Your Property Taxes

P T R C Inc Property Tax Reduction Consultants Tax Grievance Services In Nassau County Ny And Suffolk County Ny